PENSION CREDIT

If you are over State Pension age and on a low income, you could get extra money to help with living costs through Pension Credit.

Pension Credit can top up your weekly income to £218.15 if you are single, £332.95 for a couple.

With Pension Credit, you can also get even more extra money if you are: a carer, severely disabled, or responsible for a child or young person

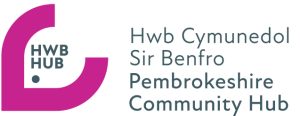

AM I ELIGIBLE?

You must live in England, Scotland or Wales. If you are single, you must have reached State Pension age.

If you have a partner, you must have both reached State Pension age, or one of you must be getting Housing Benefit for people over State Pension age.

Pension Credit is based on your income. If you are single and your weekly income is under £218.15, or if you have a partner and your joint weekly income is under £332.95, Pension Credit can top you up to that amount.

If your income is higher, you might still be eligible for Pension Credit if you have a disability, you care for someone, or you have savings or housing costs.

Not Everything Counts as Income. When calculating your income, only the following are counted: state pension. other pensions, earnings from employment and self-employment, most social security benefits, for example Carer’s Allowance, and savings over £10,000 (£1 extra ‘income’ for every £500 over £10,000)

The following do NOT count as income: Adult Disability Payment, Attendance Allowance, Christmas Bonus, Child Benefit, Disability Living Allowance, Personal Independence Payment, Social fund payments like Winter Fuel Allowance, Housing Benefit, and Council Tax Reduction.

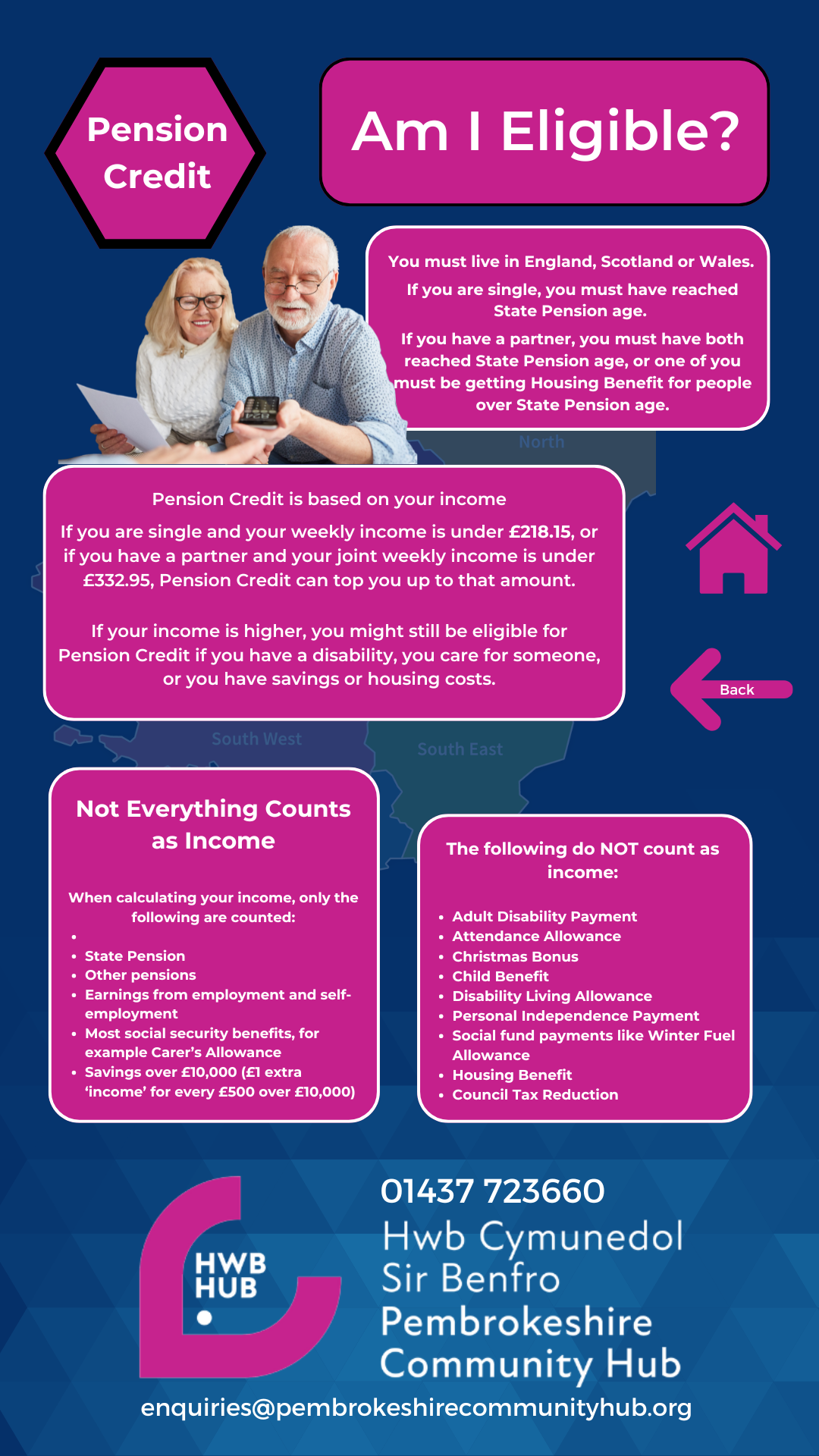

WHAT COULD I GET?

As well as topping up your weekly income, with Pension Credit you could also get a wide range of other benefits.

What else could I get? Housing Benefit if you rent, Winter Fuel Payment, Support for Mortgage Interest, a Council Tax Discount, a Free TV Licence if you are over 75, help with NHS Dentistry, Glasses and Transport costs, help with your heating costs, a discount on the Royal Mail redirection service.

You could also claim extra if...you have a severe disability, are a carer for another adult, are responsible for a child or young person under 20, you have savings or a second pension, you have housing costs.

Use the Pension Credit calculator to work out how much you might get.

www.gov.uk/pension-credit-calculator

HOW DO I APPLY?

There are many ways to apply for Pension Credit.

Apply Online at: apply-for-pension-credit.service.gov.uk

Apply by Phone: all the Pension Credit claim line: telephone: 0800 99 1234; textphone: 0800 169 0133

Monday to Friday 8am-6pm.

Apply by Post

Print out a copy of the claim form: www.gov.uk/government/publications/pension-credit-claim-form--2

Or, call the claim line to request a form.

Send completed forms to: Freepost DWP, Pensions Service 3

Make sure you have your National Insurance Number, bank details, and details of your income, savings and investments.

For more information please call Pembrokeshire Community Hub on 01437 723660;

or email: [email protected]